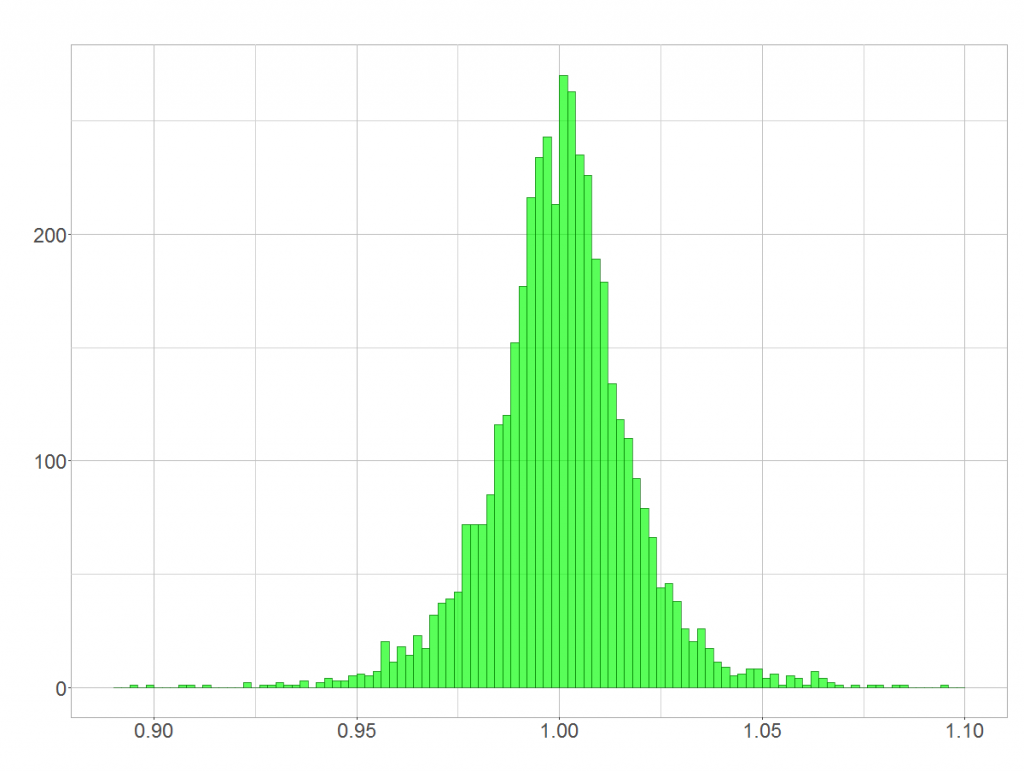

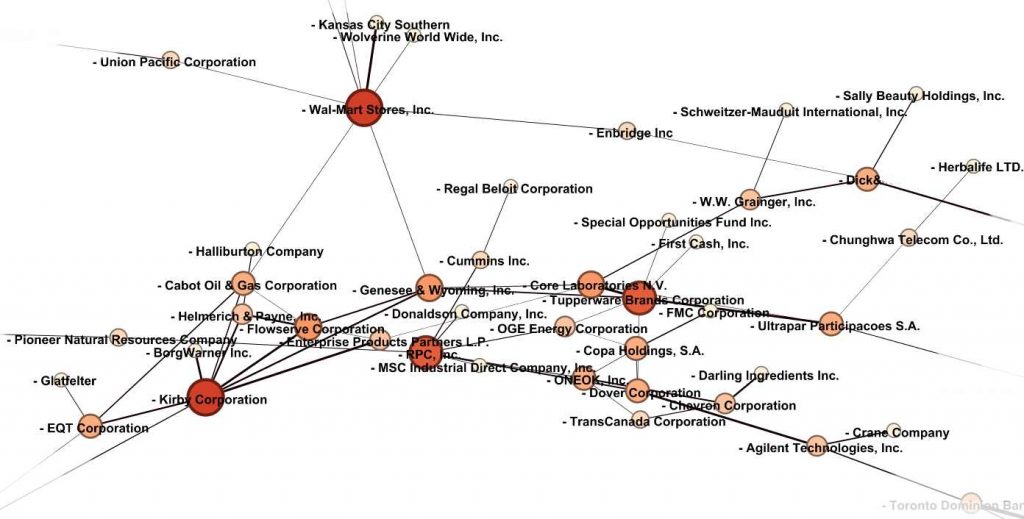

Today we have an interesting experiment. Let’s take a huge load of data on NYSE share performance, do some filtering and forward the result into Gephi. Take a look below for some pretaste.

Knowing which shares tend to move with each other can be valuable information in your market analysis. It’s up to you whether you want to learn about Stock Data Downloader / Gephi first or whether you want to get your insights straightaway – here we go. more →

Knowing which shares tend to move with each other can be valuable information in your market analysis. It’s up to you whether you want to learn about Stock Data Downloader / Gephi first or whether you want to get your insights straightaway – here we go. more →